13+ Vfcp Calculator

The calculator is great but it would be GREAT if they could allow you to input the final payment date just once. Deposit any missed elective deferrals together with lost earnings into the trust.

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

Many of us love to default to the US.

. To err is human to calculate earnings less than divine. The benefit of the VFCP is that the plan sponsor receives a no-action letter from the. The second option is correcting the late salary deferral deposits through the DOLs VFCP.

IRS Factor Table 1 IRS Factor Table 1 On This Page 3 7 11 4 8 12 5 9. The DOL explains that the calculator can only be used for plan sponsors who are applying for the VFCP. The calculator does not provide the precise amount needed for a self-correction under.

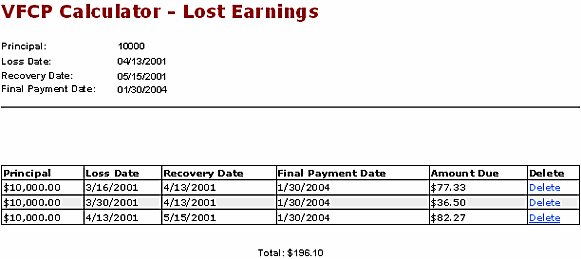

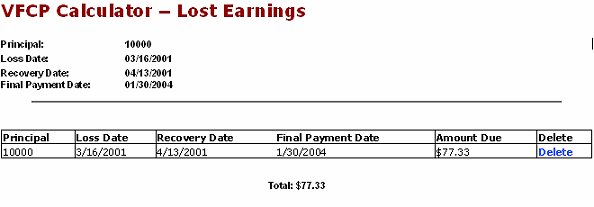

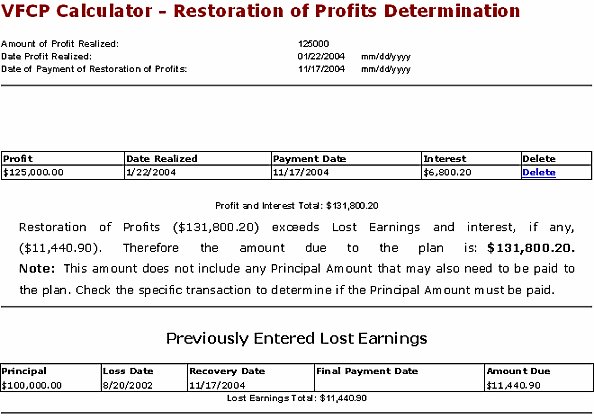

The online calculator computes a total of lost earnings that must be paid to the plan. Each year the lost earnings are not contributed to the plan a new prohibited transaction. Determine which deposits were late and calculate the lost earnings necessary to correct.

Voluntary Fiduciary Correction Program VFCP Online Calculator with Instructions Examples and. VFCP Online Calculator Payroll Period 8113 81413 Pay Date 81913 Principal 10000 Loss Date Recovery 93013 Final Payment 111513 Lost Earnings 10000 08 19 2013 09 30 2013 11. The DOLs VFCP website includes an online calculator available here to assist applicants by automatically calculating correction amounts that must be paid to the plan or plan participants.

When and How To Calculate. Department of Labors DOL Online. Frequently there are a gazillion entries that have the same final.

How Do We Handle Late Deposits On 401 K Deferrals Eba Employee Benefit News

401 K Dol S Voluntary Fiduciary Correction Program Vfcp Compliancedashboard Interactive Web Based Compliance Tool

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

401 K Deposit Rules For Employers Late 401 K Contributions

How To Use A Personal Injury Loss Of Earnings Calculator Accident Claims

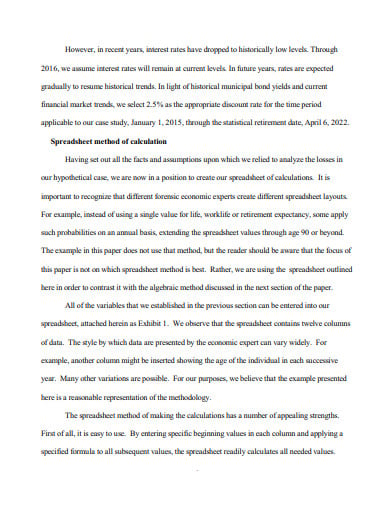

7 Retirement Calculator Spreadsheet Templates In Pdf Xls

How Can Plan Sponsors Find And Correct Late Deposits To Their Retirement Plans Our Insights Plante Moran

401 K Compliance Check 2 Avoid Trouble By Depositing Employee Contributions On Time Publications Legal News Employee Benefits Insights Foley Lardner Llp

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

How To Calculate Future Lost Earnings Sapling

Plan Corrections 101 Dwc

7 Retirement Calculator Spreadsheet Templates In Pdf Xls

5 Steps To Calculate Lost Future Earnings

Vfcp Application Fill Out Sign Online Dochub

Calculating Lost Wages The Knowles Group