Depreciation equation calculator

Select the currency from the drop-down list optional Enter the. Unit of Production Method.

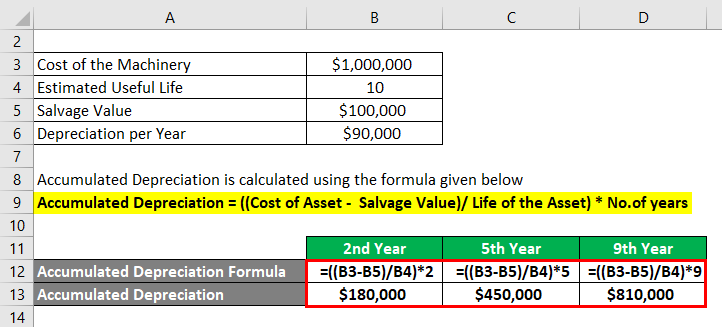

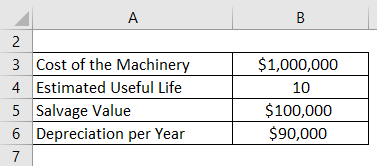

Accumulated Depreciation Formula Calculator With Excel Template

How to Calculate Straight Line Depreciation.

. Determine the cost of the asset. Select your Quote Currency. Calculator for depreciation at a declining balance factor of 2 200 of.

Depreciation is calculated using the formula given below. Enter your starting quote exchange rate 1. Calculate the Depreciation Amount to be Considered.

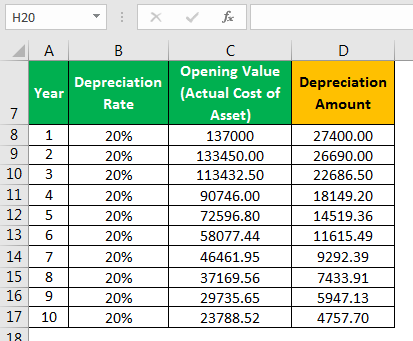

Estimate the useful life of the fixed assets and calculate the depreciation amount to be reduced from the asset value each year. The double declining balance calculator also uses the same. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule.

Depreciation Asset Cost Residual Value Life-Time. The double declining balance depreciation expense formula is. Depreciation Expense 2 x Cost of the asset x depreciation rate.

For example The original price of an asset is 5000 the estimated useful life is 5 years and the estimated net. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below. When the value of an asset drops at a set rate over time it is known as straight line depreciation.

Select your Base Currency that you want to quote against. The Formula used by Depreciation Calculator. All you need to do is.

The straight line calculation steps are. This depreciation calculator is for calculating the depreciation schedule of an asset. Where Di is the depreciation in year i.

22 Diminishing balance or Written down. Annual depreciation rate total useful lifetotal estimated useful life. Lets take a piece of.

Asset Cost Salvage Value Useful Life Depreciation Per Year. First one can choose the straight line method of. Straight Line Depreciation Calculator.

The basic formula for calculating your annual depreciation costs using the straight-line method is. Lets take an asset which is worth 10000 and. Periodic straight line depreciation Asset cost - Salvage value Useful life.

This free downloadable PDF is fantastic for calculating depreciation on-the-go or when youre without mobile service to. DOWNLOAD THE CLAIMS PAGES DEPRECIATION GUIDE. It provides a couple different methods of depreciation.

C is the original purchase price or basis of an asset. 2 Methods of Depreciation and How to Calculate Depreciation. It is fairly simple to use.

Subtract the estimated salvage value of the asset from. The calculator also estimates the first year and the total vehicle depreciation. This car depreciation calculator is a handy tool that will help you estimate the value of your car once its been used.

These are set at 1 base currency unit. Depreciation 330000 in year 1 and 2. It can be calculated using its depreciation.

21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. You probably know that the value of a vehicle drops. The MACRS Depreciation Calculator uses the following basic formula.

Salvage value is the estimated resale value of an asset at the end of its useful life. D i C R i.

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate Formula Examples How To Calculate

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Formula Calculator With Excel Template

Straight Line Depreciation Formula And Calculator

Depreciation Formula Calculate Depreciation Expense

Free Macrs Depreciation Calculator For Excel

Accumulated Depreciation Formula Calculator With Excel Template

Double Declining Balance Depreciation Calculator

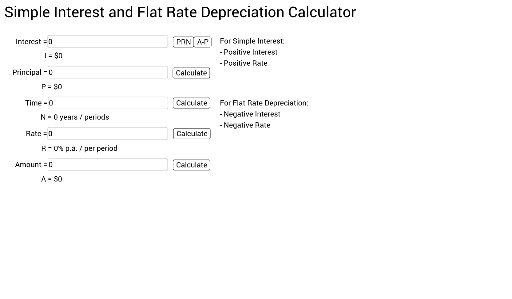

Simple Interest And Flat Rate Depreciation Calculator Geogebra

Depreciation Formula Calculate Depreciation Expense

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Calculation

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Calculator Depreciation Of An Asset Car Property